India’s IPO Wave: Are We in a Bubble or a Boom?

In the past few months, India’s IPO market has been on fire. Every week, a new company seems to be listing, and every other headline screams “record oversubscription.”

But the real question is are we witnessing a sustainable boom or are we quietly inflating a bubble that’s bound to burst?

Let’s break it down.

The IPO Frenzy

In FY25 so far, over 60 companies have gone public, collectively raising more than ₹65,000 crore the highest since FY21’s startup IPO rush.

From manufacturing and fintech to EV components and consumer brands, investors are rushing to grab a piece of every story that promises growth.

The subscription numbers look impressive too. Retail participation has surged, with applications crossing all-time highs. HNIs and institutional investors aren’t staying behind either.

But dig a little deeper, and a different picture begins to emerge.

What’s Driving the Boom?

1. Liquidity and Optimism

India’s strong GDP growth (hovering around 7–7.5%), falling inflation, and improving corporate profits have created a perfect cocktail for investor confidence. Add to that the global rotation of capital with foreign funds trimming exposure to China and increasing allocations to India and you have liquidity pouring into Indian equities.

When liquidity is abundant, risk appetite rises. And IPOs become the easiest way to ride the “India growth” narrative.

2. Retail Participation

According to NSE data, over 3.6 crore new demat accounts were opened in FY24 alone. Most of these investors are young, tech-savvy, and hungry for quick returns. IPOs with their lottery-like allotments and listing pop excitement are the perfect bait.

But enthusiasm without experience often leads to speculation. And that’s where caution is needed.

3. Sectoral Momentum

The new-age IPOs of 2021–22 may have burned investors initially, but traditional sectors engineering, capital goods, pharma, and manufacturing are now driving the comeback. These are businesses with real profits, assets, and order books which is why the rally looks more grounded this time.

However, valuations are still stretching. Many companies are listing at P/E multiples of 40x–70x, pricing in years of future growth. That’s where the line between boom and bubble starts blurring.

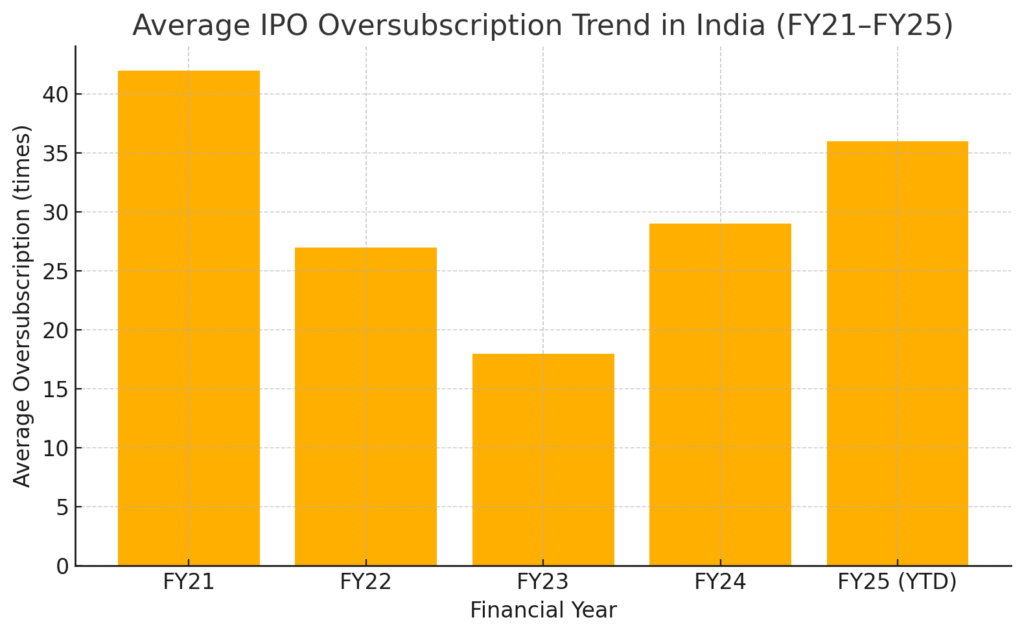

IPO Oversubscription Trends

A quick look at recent trends shows that investor enthusiasm remains high even after the rollercoaster of 2022–23.

📊 Average IPO Oversubscription Trend in India (FY21–FY25)

(Data Source: NSE, BSE filings)

The trend clearly shows that while enthusiasm cooled after FY21’s frenzy, it’s now rebounding strongly in FY25 suggesting revived optimism but also possible overheating.

What the Numbers Say

The BSE IPO Index has risen nearly 45% in the past year, outpacing the benchmark Nifty by a wide margin. But this index doesn’t tell you how many IPOs have underperformed after listing.

Here’s the reality check:

- Roughly 35% of IPOs listed in FY24 are currently trading below their issue price.

- Several SME IPOs, after skyrocketing initially, have corrected sharply some even by 60–70%.

- Institutional investors are quietly booking profits, while retail investors often enter at inflated valuations.

In short the party is loud, but not everyone’s dancing in tune.

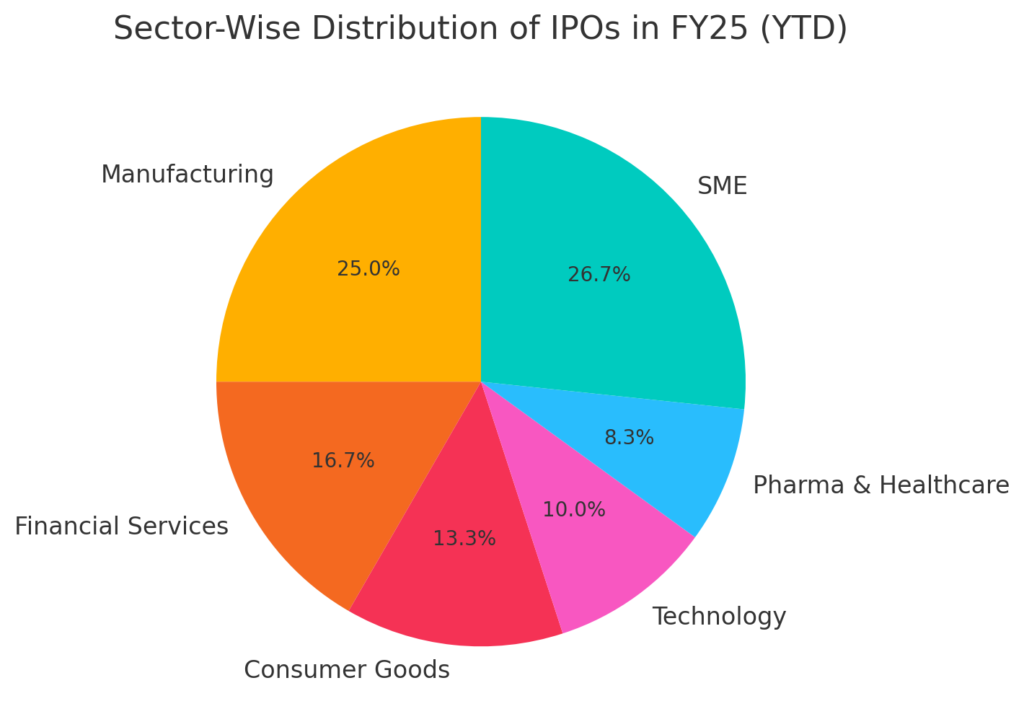

Sector-Wise Action

To understand where this IPO wave is concentrated, here’s how sectoral listings look this year:

📈 Sector-Wise Distribution of IPOs in FY25 (YTD)

(Data Source: BSE, FY25 YTD filings)

Manufacturing and SME listings dominate, showing India’s shift toward traditional, profit-generating businesses a contrast from the startup-heavy wave of 2021.

Lessons from History

If you zoom out, India’s IPO markets have always been cyclical. There was a boom in 2007 before the global financial crisis, another in 2017 during the NBFC upcycle, and then the massive 2021–22 wave of startups like Paytm, Zomato, and Nykaa.

Each phase started with optimism, peaked with euphoria, and corrected when fundamentals caught up.

The key question is are we repeating history, or writing a new chapter?

Signs of a Bubble

Let’s call out the red flags:

- High oversubscription from leveraged HNIs using borrowed funds.

- Aggressive pricing by promoters trying to maximise valuations.

- Short holding periods, with most investors exiting within days of listing.

- Sharp volatility in SME and small-cap counters post-listing.

When short-term money chases long-term stories, it rarely ends well.

Reasons It Might Still Be a Boom

On the flip side, India’s capital markets have matured.

- Regulatory scrutiny by SEBI has tightened especially around SME listings and promoter disclosures.

- Companies coming to market now have stronger fundamentals than the startup wave of 2021.

- India’s economy remains one of the fastest-growing globally, giving genuine growth tailwinds to domestic businesses.

So while there are pockets of froth, the broader trend might still be healthy expansion not a speculative bubble.

What Should Investors Do?

A few practical takeaways:

- Don’t get swayed by listing pop hype; check fundamentals and promoter intent.

- Compare valuation multiples with peers not with emotion.

- Remember, oversubscription ≠ quality.

- Avoid SME IPOs unless you understand liquidity risks.

Most importantly, treat IPOs as investments, not lotteries. The biggest winners in IPO markets are often those who buy after the noise settles.

The Bottom Line

India’s IPO wave reflects the country’s growing economic confidence and that’s a good thing. But like every tide, it carries both opportunity and risk.

It’s not a bubble yet, but it’s not a guaranteed boom either. It’s a cycle and knowing when to ride it, and when to step back, will make all the difference.

Author: Rinal Rathi Category: Markets & Investing

Tags: #IPO #StockMarket #Investing #IndiaGrowth #FinancialTrends